Compound Interest Calculator Guide: Calculate Future Value of Investments

Calculating compound interest is essential for investment planning, savings goals, and understanding how your money grows over time. Our free compound interest calculator makes this process simple. According to Wikipedia, compound interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. Compound interest is contrasted with simple interest, where previously accumulated interest is not added to the principal amount of the current period.

What is a Compound Interest Calculator?

A compound interest calculator is a tool that calculates the future value of investments with compound interest. It helps you determine how much your investment will be worth in the future, total interest earned, and provides a year-by-year breakdown showing how your investment grows. Compound interest calculators are essential for anyone planning investments, savings, or retirement.

Why Use a Compound Interest Calculator?

Common reasons to use a compound interest calculator:

- Investment Planning: Calculate future value of investments and plan your investment strategy

- Savings Planning: Plan your savings goals and see how compound interest grows your money

- Retirement Planning: Plan for retirement and see how your investments grow over time

- Education Savings: Plan for education expenses and calculate savings growth

- Goal Setting: Set financial goals and see how long it takes to reach them

How to Calculate Compound Interest

Using our compound interest calculator:

- Visit the compound interest calculator page - no registration required

- Enter the initial investment amount (principal)

- Enter the annual interest rate percentage

- Enter the number of years for the investment

- Select the compounding frequency (how often interest is compounded)

- Enter monthly contribution amount if you plan to add money regularly (optional)

- Click "Calculate" to get future value, total interest, and year-by-year breakdown

Key Features

Our compound interest calculator offers:

- Compound Interest Calculation: Calculate future value with compound interest

- Monthly Contributions: Support for regular monthly deposits

- Flexible Compounding: Annual, semi-annual, quarterly, monthly, or daily

- Year-by-Year Breakdown: See how your investment grows each year

- Total Interest: Calculate total interest earned over time

- Investment Planning: Plan your savings and investment goals

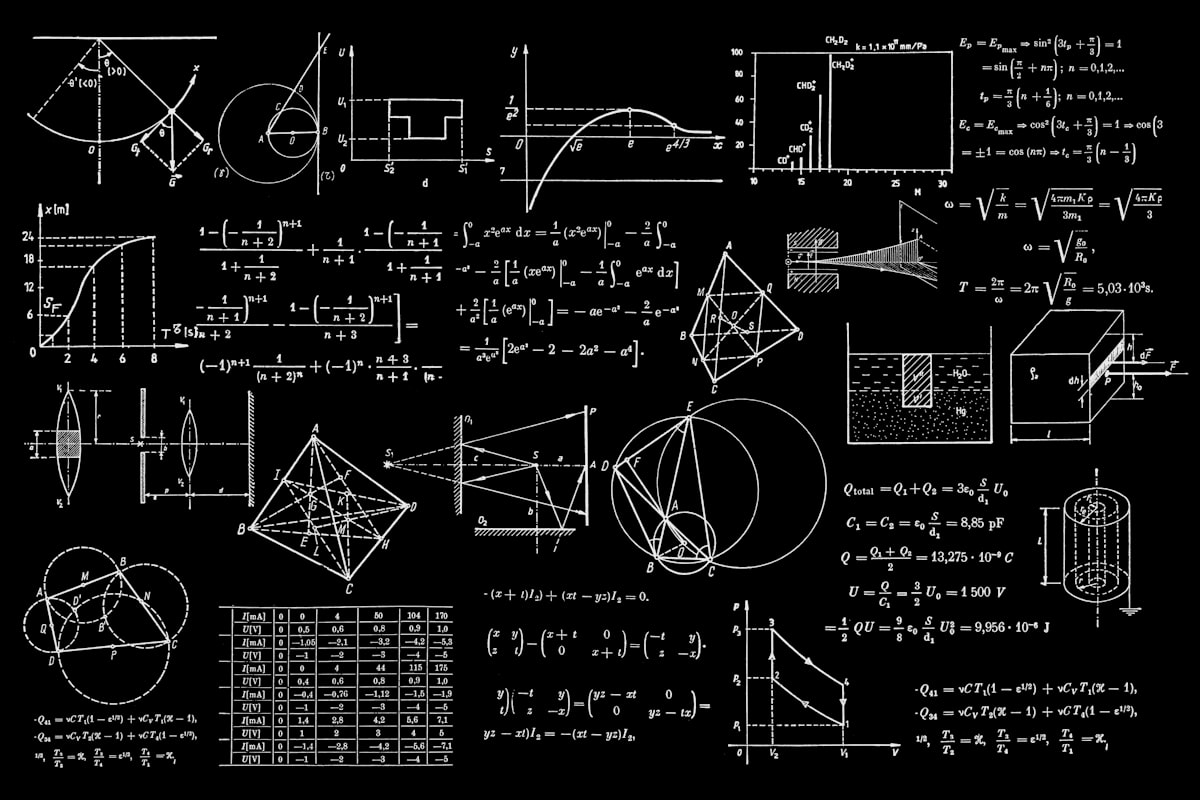

Understanding Compound Interest Calculation

Compound interest is calculated using the formula:

A = P(1 + r/n)^(nt)

Where:

- A = Future value of the investment

- P = Principal investment amount

- r = Annual interest rate (decimal)

- n = Number of times interest is compounded per year

- t = Number of years the money is invested

For example, if you invest $10,000 at 7% annual interest compounded monthly for 10 years:

- P = $10,000

- r = 0.07 (7% as decimal)

- n = 12 (monthly compounding)

- t = 10 years

- A = $10,000 × (1 + 0.07/12)^(12×10) = $20,096.61

Factors Affecting Compound Interest

Several factors affect compound interest:

- Principal Amount: Higher principal results in higher future value

- Interest Rate: Higher interest rate results in faster growth

- Time Period: Longer time period allows more compounding

- Compounding Frequency: More frequent compounding (daily vs. annually) results in higher returns

- Regular Contributions: Monthly contributions significantly increase future value

For other financial calculations, try our Loan EMI Calculator tool.

Tips for Best Results

To get the best results with compound interest calculation:

- Enter accurate principal, interest rate, and time period for precise calculations

- Consider different compounding frequencies to see their impact

- Use monthly contributions to maximize growth

- Review year-by-year breakdown to understand growth pattern

- Factor in inflation when planning long-term investments

- Compare different investment options using the calculator

Common Investment Scenarios

Our calculator works for various investment scenarios:

- Savings Accounts: Calculate growth of savings accounts with compound interest

- Fixed Deposits: Calculate returns on fixed deposits and term deposits

- Mutual Funds: Estimate future value of mutual fund investments

- Retirement Accounts: Plan for retirement with 401(k), IRA, or similar accounts

- Education Savings: Plan for education expenses with 529 plans or similar

Related Number & Date Tools

Check out these related tools:

- Loan EMI Calculator - Calculate EMI for home loans, car loans, and personal loans

- Percentage Calculator - Calculate percentage of a number, increase/decrease, and more

- Time Zone Converter - Convert times between different time zones

- Roman Numeral Converter - Convert numbers to Roman numerals and vice versa

For more number and date tools, explore our Number & Date Tools category. You might also find our guides on loan EMI calculation and percentage calculation helpful.

Conclusion

Calculating compound interest is essential for investment planning, savings goals, and understanding how your money grows over time. Our free compound interest calculator makes this process simple. With support for monthly contributions, flexible compounding frequencies, and comprehensive results, it's perfect for all your investment planning needs.

Start calculating compound interest today with our free compound interest calculator!